Which is better Sip Or Lumpsum we all have came across this question and in this content you are going to get the answer to this question,so let’s start .

PARAMETERS TO JUDGE

FLEXIBILITY

Sip tends to provide the flexibility to the investors having small capital , the myth that ‘ WE REQUIRE A HUGE CAPITAL FOR INVESTMENT ‘ is resolved by the concept of sip’s.First task is to decide a fund and once decided , then the duty is to start investing before it’s too late.The common problem among the people is the market conditions some feels that the markets are quite expensive let’s wait for a retracement or a correction (i.e. they wait for the markets to fell down )while other’s think that the markets are down so let’s wait till the markets recover (i.e. when the markets are in the rising pattern). Both the persons are wrong. For that the one and only solution is of SIP.

Inspite of any market conditions or the sentiments, we are able to continue the investments today for a better tomorrow.

The people who doesn’t have a huge amount of money can also benefit from this as they can invest as low as (100 rupees)and your money gets diversified in several sectors.

Where in case of buying the stocks we can buy a stock from a particular sector if it fits in our budget of 100 rupees,sometimes it may not be sufficient to buy our favourite stock as well;though you are starting from a small capital you are getting the no. of units of a fund in which you are investing (i.e small portion of a company),and in low cost also your investment gets diversified then what a kind of happiness it is? ,while in case of lumpsum we are investing the capital in one stroke which is quite risky.

CONSISTENCY

See the markets are the cycle and we should be able to handle the up’s and down’s of the markets and to invest in each and every market scenario is important in the matter of compounding.

Sip is quite beneficial here as we are investing a small amount consistently so our discipline in the investing is maintained whereas we benefitted from the rise and fall of the markets because when the markets are rising (BULL MARKET) you are getting the less no. of units.

Whereas when the markets are falling (BEAR MARKET) then the more amount of units we get;thus we are benefitted by the rupee cost averaging,also many investors are worried in Bear markets and so they don’t even invests, they wait for the pullback and then the markets get up and makes a new high when this news is heard by these kind of people they regret

‘WHY I DIDN’T INVEST IN THAT TOUGH SCENARIO ?’so this regret kills the confidence and so these participants are out from the markets.One more point is that in the tough situations we cannot buy the stocks in the falling markets as the professionals who are having deep knowledge will think for it,but the biggest benefit is investing in the INDEX as INDEX will always give you some returns.

(A stock could be zero if it is taken out from the index but the index is consists of multiple companies and so cannot be zero),in the tough times we can’t even invest a capital one stroke as that of Lumpsum so we are investing a few amount consistently and in a staggered manner so we are passive participating in the tough times with lowering the risks from our side.

To remain in the markets is very important rather than making the runs as the ball is going to be bowled every day but we need to save our wicket which is our capital ; because if capital vanishes, then we are ultimately out from the markets.

BULL MARKETS CREATE MONEY BUT BEAR MARKETS CREATE WEALTH

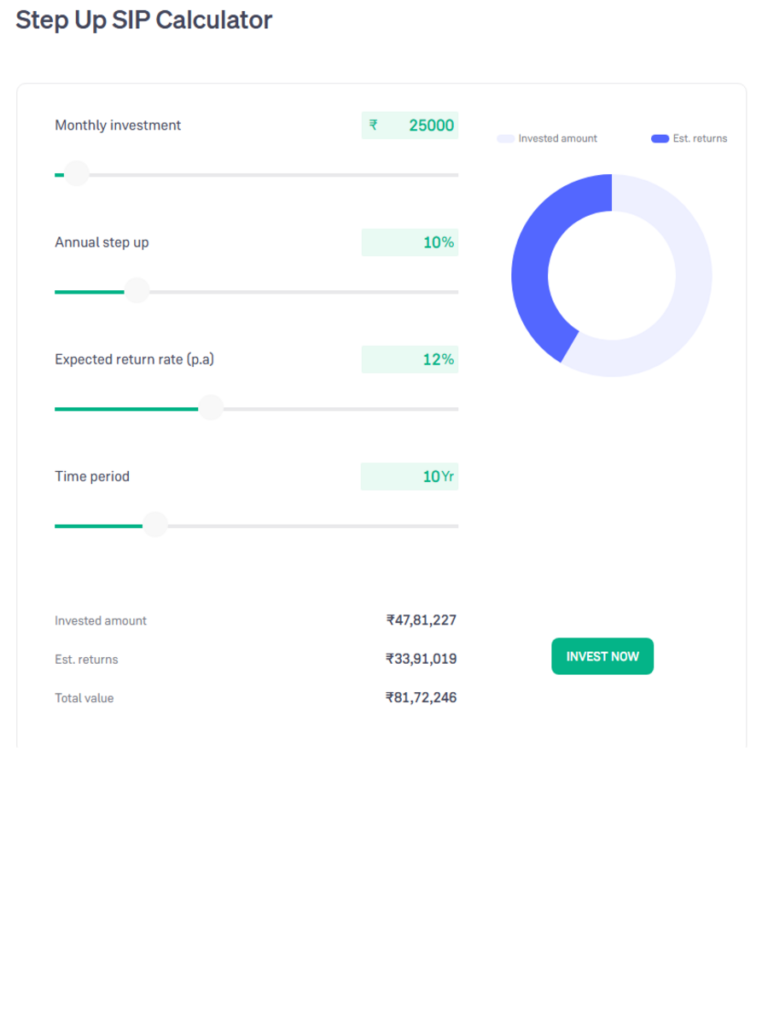

Investing in the tough scenarios will ultimately appreciate you as the concept behind the markets tells us that when there is a huge fall then afterwards the markets don’t walk,they just jumps in the bullish manner. In such scenarios when we are planning to invest all the capital then well might come across the loss and practically it is not good to invest all the money in the bear markets (i.e.Falling Markets) by doing the step up sip at such times is the smart investing method.

ANALYSIS

One need to very perfect to define when he or she is going to invest the capital in one stroke and we all knows that the markets are volatile.So investing Lumpsum can increase the risks as well , always a staggered investment is better.If the analysis goes wrong then it impacts us emotionally too as we have only that capital with us and now what to do ? Always it is not possible that high risks gives you high reward. We should maintain the risk-reward ratio , the reward is not in our hands that the markets will give us , what is in our hand is the risk .

CONCLUSION

If we observe keenly then we could notice that the SIP gives us the advantage of Flexibility,Consistency,Participation in the tough scenarios which will always appreciate you, whereas the LUMPSUM is not having that much advantages only it comes in 50-50 category if the analysis is right then the reward and if not then the loss.The most important benefit is that the returns are quite great and amazing in case of SIP.

So most beneficial and most suitable way is the SIP the clear winner.

Do follow us –https://billionairepathak.blogspot.com/

Check out the MUTUAL FUNDS MASTERY SERIES as well – PART 1 https://bullishblogger.com/mutual-funds-mastery-part-1/

PART 2 https://bullishblogger.com/mutual-funds-mastery-part-2/

PART 3 https://bullishblogger.com/mutual-funds-mastery-part-3/

See you in the next content so till then STAY HUNGRY STAY BULLISH

[…] Checkout our Popular Posts – Which is better Sip Or Lumpsum […]